Outlook is positive for African air cargo carriers as trade with China grows

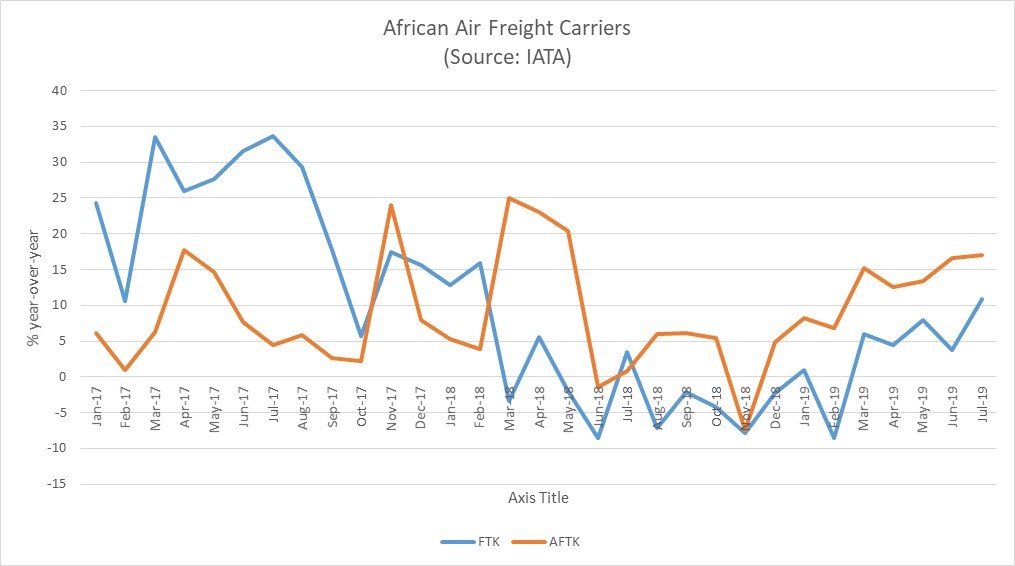

African carriers have been a shining star in an otherwise dismal global airfreight market. Year-to-date through July, freight tonne kilometers (FTKs) are up 4.9% year-over-year while capacity is up 13.6%. This region has been on an upward but erratic path in recent years with much of the growth attributed to its trade relations with Asia-Pacific.

For 2017, IATA noted that airfreight demand increased 59.0% between Africa and Asia. The gain was due to an increase in the number of direct flights between the two regions, driven by ongoing foreign direct investment flows into Africa. However, by the end of 2018, overall freight demand among African carriers decreased by 1.3% with capacity growing only 1.0%. This year, it appears there is a positive growth rebound because of inbound investment flows from Asia-Pacific.

While volumes are positive year-over-year, growth in capacity outpaces volumes, which can be concerning from a rate perspective.

Representing less than 2% of the global airfreight market, Africa’s potential is immense. The continent is home to about 15% of the world’s population including a burgeoning middle class with great spending power.

But, like other emerging regions, infrastructure remains problematic. Experts cite customs procedures and agencies as slow to process cargoes. The lack of intra-African trade is also a hindrance as is high overflight and landing charges in Africa. In fact, it is more expensive to fly in Africa than in any other region.

To reduce such costs and encourage intra-regional trade, a 55-nation free trade zone was established earlier this year creating a $3.4 trillion economic bloc. Members have pledged to eliminate tariffs on most goods. Still, other issues including poor road and rail links, border bureaucracy and corruption will also need to be addressed.

According to the United Nations Conference on Trade and Development’s (UNCTAD) World Investment Report 2019, foreign direct investment in Africa increased by 11.0% in 2018 from 2017. France, the Netherlands and the United States remain the top investors in the region. However, China, which is the fifth-largest investor, is moving up the list quickly by increasing African investments from 2013 to 2017 by 65.4%. Investments range from infrastructure to specific industries. In terms of airports, Chinese investments have benefited those in Kenya, Mali, Mauritius, Mozambique, Nigeria, the Republic of Congo, Togo and Sierra Leone.

The investments coincide with an increase in overall trade between China and Africa. According to John Hopkin University’s China-Africa Research Initiative, Chinese total exports to Africa increased 10.4% in 2018 while Chinese total imports from Africa increased 64.9% for the same period.

As noted previously, IATA highlighted the growth of direct flights as one reason for the growth in air cargo volumes between China and Africa. According to Quartz Africa, on an average day, eight direct flights operate between China and African nations, compared to 2010 in which airlines averaged less than one flight per day.

Ethiopian Airlines is credited with many of the direct flights between China and Asia, growing from no direct routes in 2010 to almost half of the 2,616 annual flights operating today.

As the largest airline operator in Africa, Ethiopian Airlines is quickly expanding its fleet. According to Cargo Facts, it took delivery of its tenth 777F, unit 65477, in June. The airline is also looking to expand its intra-Africa reach by putting the first of two 737-800SFs into regional service and is expected to finalize a deal for two additional AEI-converted 737-800SFs to support its intra-Africa network strategy.

In addition, various publications suggest that Ethiopian Airlines plans to boost flight frequencies to China from 36 flights per week to 50 flights per week. Currently, the airline has five cargo and passenger flight destinations in China – Beijing, Hong Kong, Shanghai, Chengdu and Guangzhou, and is looking to expand into Shenzhen as well.

The potential is great for Africa but at the same time, the risks are as well. Like other emerging regions, Africa is overly dependent on exports and will need to not only encourage domestic spending but also remove intra-regional hurdles in order for it to truly shine. African airlines such as Ethiopian Airlines are doing their part by expanding fleets and expanding global routes but overcoming intra-African hurdles will be the most difficult to achieve. If successful, though, it could result in not only a much stronger economic trading bloc but rival other regions in attracting foreign businesses.

Cathy Morrow Roberson is founder and president of the logistics-focused market research firm, Logistics Trends & Insights, based in Atlanta. Previously, Cathy spent several years with consulting firms, as well as with UPS Supply Chain Solutions, where she supported its market, operations, competitive and mergers & acquisition research and analytics. She also is a Senior Consultant at Cargo Facts Consulting and writes a weekly column for Air Cargo World.