Global airport throughput rebounds in March

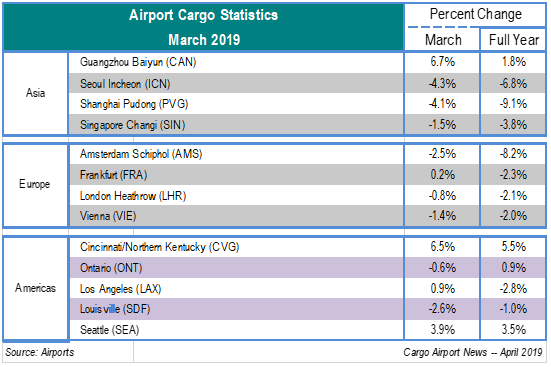

Preliminary results from global airports indicate that the air cargo market improved in March from the steep declines in volumes witnessed during the first two months of the year. Overall, while the first quarter of 2019 was rocky, the resurgence in cargo throughput suggests that a couple of weak months may not portend a down 2019.

On a regional basis, airports in Asia and the Americas posted mixed results for the month, while European airports were close to flat with March 2018 volumes. An increase in March traffic reported by major carriers contributed to improved volumes at airports this month, especially in Asia, as our sister site Cargo Facts reported. Meanwhile, European airports – which are still navigating drawn-out Brexit negotiations – noted increased trade with Africa, America, Latin America and the Middle East.

Now onto March airport on a regional basis:

Asia Pacific

Guangzhou Baiyun International Airport (CAN) reported its March cargo throughput increased 6.7% y-o-y to 166,584 tonnes – comprised of 156,919 tonnes of freight and 9,665 tonnes of mail. For the full year, CAN’s cargo handle increased 1.8% to 430,121 tonnes.

Incheon Airport (ICN) saw its cargo handle drop 4.3% y-o-y in March to 248,642 tonnes. For 2019 year-to-date, ICN’s cargo handle was down 6.8% y-o-y to 648,957 tonnes.

Shanghai Pudong International Airport (PVG) handled 314,200 tonnes of cargo in March, reflecting a 4.1% y-o-y decline in cargo volume. International cargo tonnage fell 3.9% for the month, while domestic cargo volumes fell by 1.0%. March figures were still a dramatic improvement. Year-to-date, cargo volumes fell by 9.1%.

Singapore (SIN) reported its March cargo handle declined 1.5% y-o-y to around 190,000 tonnes, the first positive result this year. For the first three months of the year, SIN’s handle was down about 3.8% to around 493,000 tonnes. SIN attributed the decline in its first quarter volumes to slowdown in global trade flows and said that all cargo flows – exports, imports and transshipments – have weakened.

Europe

Amsterdam Airport Schiphol’s (AMS) cargo handle fell 2.5% y-o-y in March, to 144,787 tonnes. For the full year, AMS’s cargo handle fell 8.5% to 383,227 tonnes. Although AMS posted overall declines y-o-y for the month in both inbound and outbound cargo of 2.9% and 2.1%, respectively – inbound cargo from the Middle East increased 9.0%, while outbound volumes within Europe and to the U.S. increased y-o-y by 18.4% and 7.0%, respectively.

Frankfurt Airport (FRA) reported a 0.2% increase in its y-o-y cargo handle for March, to 202,452 tonnes. For the full year, FRA’s cargo handle declined 2.3% to 527,151 tonnes. FRA attributed the decline to a slowdown of the international trade due to the Easter holidays. However, FRA said that there has been increased traffic to and from Moscow and Istanbul, while the U.S. and Kenya were generators for growth, with cargo volumes to and from the airport up 10.0% and 2.6%, respectively. Cargo connected to both Latin America and Asia, however, were down.

London’s Heathrow Airport (LHR) reported a 0.8% decrease y-o-y in its March cargo handle, to 149,417 tonnes. Volumes at the airport were down 2.1% for the full year, compared to the same period in 2018. Regionally, volumes to and from Africa and Latin America were up for the month, while cargo to all other regions declined.

Vienna Airport’s (VIE’s) cargo handle fell 1.4% y-o-y in March, to 25,197 tonnes. For the full year, VIE’s air cargo handle declined 2.0% to 66,641 tonnes, compared to the same period the year prior.

Americas

Cincinnati/Northern Kentucky (CVG) reported that its cargo volumes increased 6.5% y-o-y in March and reached 112,002 tonnes in throughput. Year-to-date, cargo volumes are up 5.5% at the airport, continuing the airport’s growth since January.

Ontario International Airport (ONT) handled 59,907 tonnes of cargo, resulting in a 0.6% decrease in March cargo volumes over the year prior. Freight and mail volumes both contributed to the monthly decline in throughput, with declines of 0.2% and 8.9%, respectively. ONT’s cargo handle year-to-date, on the other hand, increased 0.9% y-o-y to about 171,725 tonnes.

Los Angeles (LAX) reported a 0.9% increase y-o-y in its March cargo handle, to 208,253 tonnes. Volumes at the airport were down 2.8% for the full year, compared to the same period in 2018.

Louisville’s (SDF’s) cargo handle fell 2.6% y-o-y in March to 474,672 tonnes. Declines in both international and domestic freight, parcels and cargo volumes both contributed to the overall slowdown in cargo at the airport – international volumes fell 0.8% and domestic volumes fell 2.8%. For 2019 year-to-date, SDF’s cargo handle was down about 1.0% to 1,356,748 tonnes.

Seattle-Tacoma International Airport’s (SEA’s) cargo handle increased 3.9% y-o-y in March, to 35,381 tonnes. SEA’s air cargo handle rose 3.5% to 98,478 tonnes, compared to the same period the year prior. SEA attributed its March growth to increases in freight volumes at the airport by 5.0% overall – domestic freight increased by 5.4% and international freight volumes increased by 4.0%.