No products in the cart.

The Freight 50: 2018’s top carriers standing strong in the face of headwinds

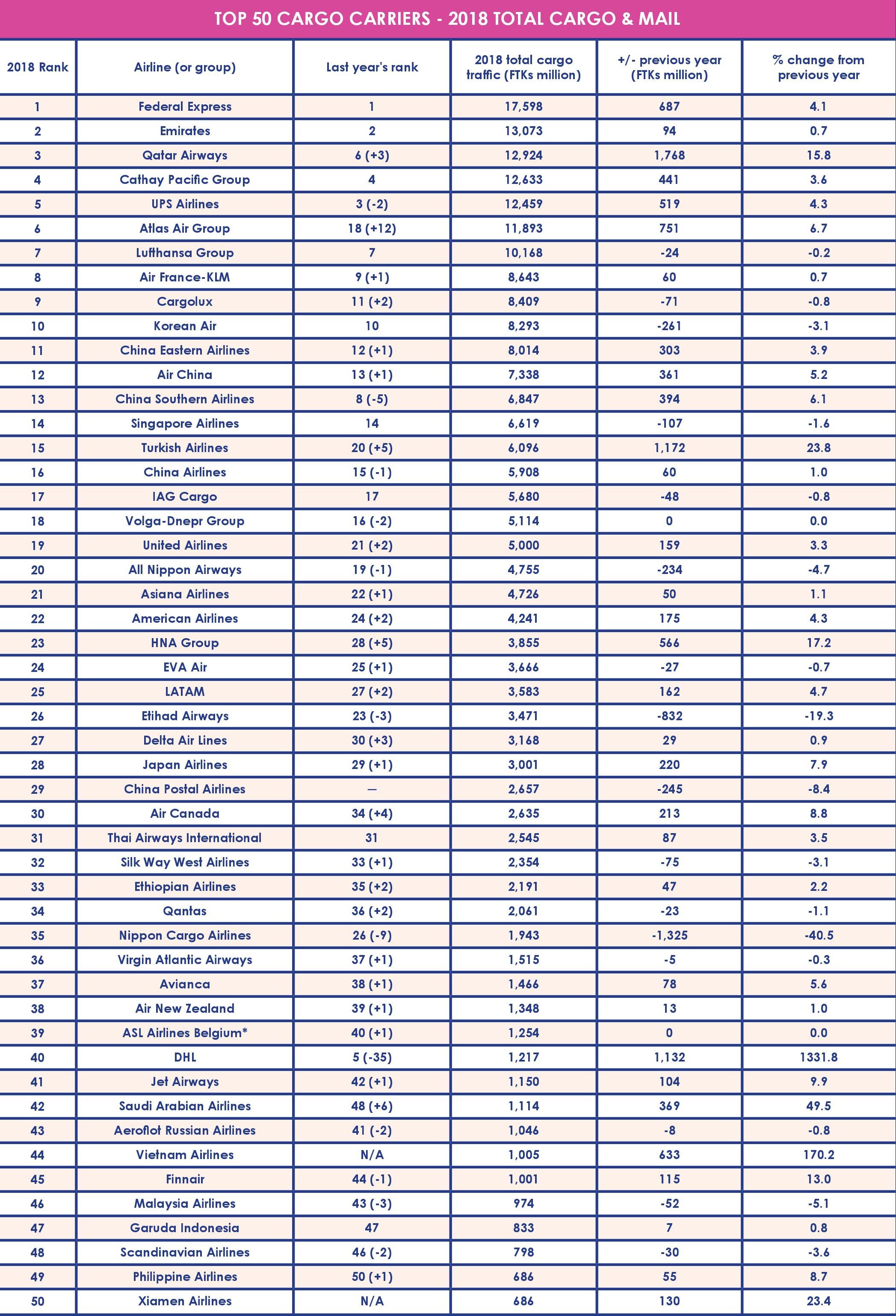

Signs of a slowdown in global trade and airfreight demand had already begun to surface last year, and in 2019 have materialized into a challenging global economic environment. This year’s headwinds, however, did not come as a major surprise to the industry, where leaders had warned of the eventual consequences of erecting trade barriers and discouraging the free flow of goods across the globe. When Air Cargo World last year spoke to carriers among the top 50 in providing air cargo lift across the globe during 2017, airline representatives warned that turbulence was likely ahead for airfreight. The question, then, is how are the world’s major cargo carriers adjusting to the new challenges?

The top two carriers – respectively, FedEx and Emirates SkyCargo – maintained their places from 2017, although Emirates’ traffic growth slowed substantially to only 0.7%, down from 5.8% growth from 2016 to 2017. Cathay Pacific Group also held its No. 4 spot, with a 3.6% y-o-y increase. Apart from those spots, however, 2018 saw a newcomer join the top five carriers, and one express carrier may be on its way out of the top five.

2018’s Top Five

Following FedEx and Emirates in spots No. 1 and 2, Qatar Airways Cargo leapfrogged its way into the top five to hold the No. 3 spot overall in 2018 cargo traffic, up from No. 6 for 2017. As can be seen in the chart reflecting those carriers with the largest year-over-year changes from 2017 to 2018, Qatar Airways has sustained impressive growth for years, even as airfreight enters a period of slower growth. For 2018, the carrier reported 15.8% y-o-y growth for 2018 at 12.92 billion freight tonne kilometers (FTKs), making it the largest carrier able to sustain such dramatic y-o-y increases, and putting it on track to displace Emirates from its No. 2 spot in 2019, if the carrier maintains such rapid growth.

Qatar Airways’ Chief Officer Cargo, Guillaume Halleux, told Air Cargo World that while imports into Qatar were down y-o-y during 2018, exports and transshipments both increased – by 14% and 12%, respectively. To confront more challenging market conditions, Halleux said, “We remain focused on customer service and strong commercial preference, because if you do that, then when the market is good you get the better yield, and when the market is down you are the last one to be cut.”

Cathay Pacific Group secured the No. 4 spot again, thanks to 3.6% y-o-y growth to 12.60 billion FTKs. Finally, in this year’s No. 5 spot is UPS Airlines, which fell two places in the rankings to make way for Qatar. Nevertheless, UPS reported y-o-y growth of 4.3%, coming in at just under 12.5 billion FTKs for 2018 and just ahead of Atlas Air Group’s 11.89 billion FTKs.

Page 1 of 2